What’s Holding Back Fintech Adoption in Africa and How It Can Be Fixed

- ams6549

- Oct 7, 2024

- 3 min read

The African fintech market is one of the fastest-growing in the world, driven by a young, tech-savvy population and the urgent need for financial inclusion. According to industry reports, fintech investments in Africa have soared in recent years, and innovative companies are emerging across the continent, offering solutions that cater to the unbanked and underbanked population. Yet, despite the growth potential, widespread adoption of fintech solutions faces significant hurdles. In this blog, we’ll explore what’s holding back fintech adoption in Africa and how these challenges can be overcome.

Barriers to Fintech Adoption in Africa

1. Regulatory Uncertainty and Fragmentation

African countries have varying regulatory frameworks, with some more progressive than others. This fragmented regulatory landscape creates uncertainty for fintech companies trying to expand across borders. In some cases, stringent policies meant for traditional financial institutions are applied to fintech firms, stifling innovation.

Solution: Regulatory bodies need to establish clear, harmonized guidelines that cater specifically to fintech innovations. Encouraging regulatory sandboxes, like those introduced in Kenya and Nigeria, can help test new solutions in a controlled environment.

2. Lack of Financial and Digital Literacy

A large portion of the African population lacks basic financial and digital literacy, limiting their ability to understand and adopt fintech solutions. Without adequate education, people are hesitant to transition from cash to digital transactions, viewing them as complicated and risky.

Solution: Fintech companies should invest in educational initiatives that simplify digital finance concepts for local communities. Partnering with local governments, educational institutions, and community organizations can significantly improve the understanding and acceptance of digital financial tools.

3. Inadequate Infrastructure

Many parts of Africa, especially rural areas, still suffer from unreliable internet connectivity and limited smartphone penetration. This restricts the reach of fintech services, as many solutions rely on internet access and smartphones for operations.

Solution: Fintech companies can explore solutions that work on feature phones through USSD and SMS technology, ensuring wider accessibility. Investing in alternative communication methods like offline wallets and developing apps that consume minimal data can also help bridge the infrastructure gap.

4. Trust and Security Concerns

Trust is a critical issue for fintech adoption. Many African consumers remain wary of online scams and data breaches. The lack of strong legal frameworks for data protection and digital security further compounds these concerns.

Solution: Fintech companies must prioritize security by implementing measures such as encrypted communications, multifactor authentication, and transaction monitoring to build user trust. Platforms like Remflow incorporate these features, ensuring secure transactions with zero fees and transparent processes, which are essential for gaining consumer confidence.

5. Limited Payment Methods and Cross-Border Support

While many African countries have vibrant local fintech ecosystems, cross-border payments remain a challenge. Traditional remittance services charge high fees, and many fintech platforms lack the necessary infrastructure to support seamless cross-border transactions.

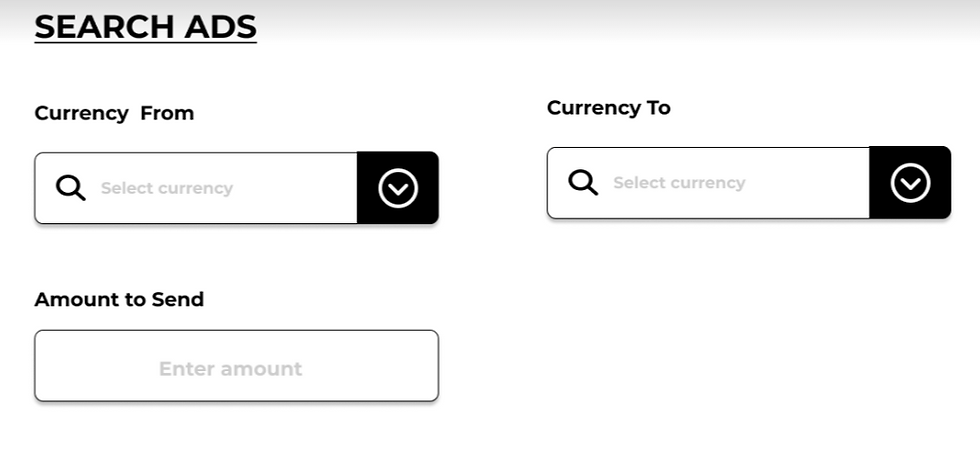

Solution: Fintech platforms like Remflow are addressing this issue by offering diverse payment methods tailored to each country’s needs. Remflow supports cross-border transactions without fees, enabling users to send and receive money securely across multiple countries, including India (INR), Argentina (ARS), and Bangladesh (BDT), among others. This helps streamline cross-border trading and remittance services, making them more accessible and affordable.

The Path Forward for Fintech in Africa

Overcoming these challenges requires a multi-faceted approach involving collaboration between fintech companies, regulatory bodies, financial institutions, and the community at large. Here’s how Africa can accelerate fintech adoption:

Encouraging Public-Private Partnerships: Governments and private players should work together to build robust digital infrastructure, promote digital and financial literacy, and create enabling regulatory environments.

Leveraging Local Knowledge: Companies must develop products and solutions that are deeply rooted in local realities, understanding the unique needs of different regions. For example, Remflow offers tailored payment methods for each country, such as UPI in India, bKash in Bangladesh, and MTN Mobile Money in Central Africa, ensuring a localized approach that resonates with the target audience.

Boosting Consumer Trust: Emphasizing transparency, security, and user education will build the trust needed to shift consumers away from cash-based systems. Remflow’s zero-fee escrow service and secure P2P trading platform are excellent examples of trust-building initiatives that address users’ concerns about digital transactions.

Integrating with Traditional Financial Systems: Fintech companies can partner with traditional banks and microfinance institutions to bridge the gap between formal and informal financial systems, thereby extending their reach to underserved communities.

Final Thoughts

Africa’s fintech sector holds immense promise, but achieving widespread adoption will require addressing the continent’s unique challenges. By focusing on regulatory clarity, infrastructure development, financial literacy, trust-building, and cross-border support, fintech companies can unlock Africa’s potential and transform the financial landscape.

At Remflow, we’re committed to enabling seamless cross-border transactions and promoting financial inclusion across Africa and beyond. To learn more about our services and how we’re overcoming these barriers, visit our website.

By aligning innovation with local needs and collaborating across sectors, we can create a more inclusive and efficient financial system for Africa’s future.

.jpeg)